We invite you to join us for our upcoming complimentary workshop we call the “Lunch & Learn” series. Each month we will be introducing new and interesting topics.

This event will be a joint collaboration between The Canadian Cancer Society and The McClelland Financial Group .

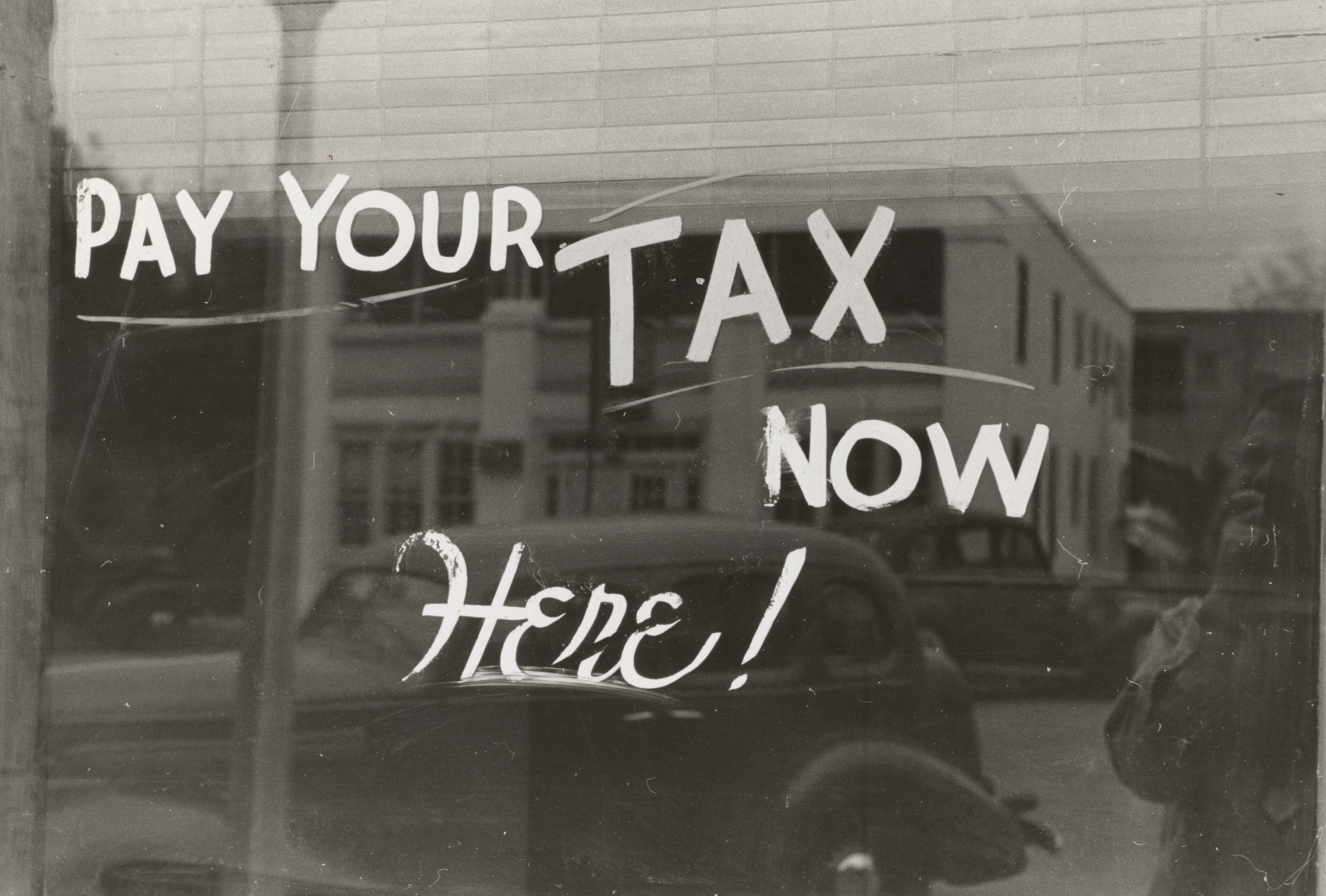

Invest just 60 minutes and it could save you and your family thousands of tax dollars…

This event took place at the Thornhill Golf & Country Club on Monday, October 20th between 12:00 and 1:00pm.

Due to the overwhelming response from his presentation last year, we are proud to welcome back Keith Thomson. Keith will be reminding us of the benefits that charitable donations can provide when used properly within an estate plan.

We will cover

- To minimize or even eliminate taxes on your estate.

- To avoid double taxation on your “Red” retirement accounts.

- To bypass paying upfront capital gains taxes when selling your investments.

- To convert assets into an income you can’t outlive and leave a lasting legacy.

- Our government wants you to save taxes and leave more to your estate!

Join us, and ask the questions you want to know

ABOUT OUR SPEAKER

Keith Thomson

These are just some of the serious concerns facing Canadians. Mike Connon, Carlo Cansino and guest speaker Keith Thomson will discuss how these issues affect Canadians and present simple solutions on how to make wiser decisions.

Keith Thomson is an internationally recognized, author and consultant, specializing in estate and charitable tax planning. Thomson has recently authored the book “What Was Your Great Grandmother’s Name? ~ 50 Thoughts On How Canadian Philanthropy Can Transform You, Your Family And Your Community” and his numerous articles have appeared in publications such as The Globe and Mail and CA magazine.

Hundreds of lawyers, accountants, financial advisors and philanthropic professionals have all benefited from his instruction. By utilizing the strategies revealed in Thomson’s presentations, entrepreneurs, professionals and retirees have been able to save and redirect to philanthropic organizations over $10 million of their “social capital”… also known as taxes. He currently serves on the Board of Directors of The Power Plant Contemporary Art Gallery and for over five years was chair of The African Medical and Research Foundation.

Keith also has acted in various leadership roles including as a past board member of The Toronto Community Foundation. Keith, his wife, Tanja, their daughter Kiera, and dog Haggis reside in the Beach neighbourhood of Toronto. Do not miss this opportunity to hear one of our nation’s most knowledgeable, entertaining and engaging speakers on the topic of how you can save income and minimize estate taxes.

While we understand all topics may not pertain to you, we ask that you forward this invitation to any friends and family you believe may benefit from the workshop.

This is a complimentary event. Lunch will be provided by The McClelland Financial Group and the Canadian Cancer Society.