Gobble Gobble! It’s that time of the year again for our southern neighbours to celebrate Thanksgiving. In the US, Thanksgiving is more than just about being with family, eating turkey and giving thanks for all that they are fortunate to have – it is about football, parades and Black Friday shopping.

American thanksgiving is predictable – Thursday is football, Thursday night is the big family dinner and at midnight people head out to do their Black Friday shopping. We’ve seen it in the news, people will wait in huge lines to participate in the deep discounts that retailers offer. And in certain stores, they may temporarily forget any sense of social etiquette they once possessed. From this behaviour we can deduce that people understand the financial benefits of purchasing goods at a discount from their “regular” price.

If this is the case, then in my opinion, Black Friday came 2 months early. The Canadian stock market was down 11% from September 1 – October 15 and the MSCI All Country World Index (global market place) was down 9% over the same time period. Using the same logic, financial advisors, brokers and other financial institutions should have had a long line up of clients wishing to invest. When markets go down, it means there are great companies for sale at a discounted price.

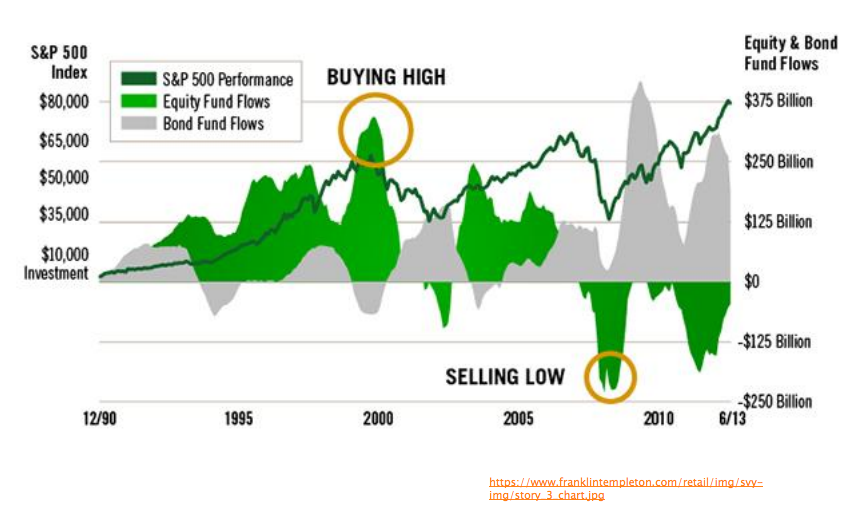

Although, over the 45 day period net equity mutual fund inflows was positive ($9 billion into US equity mutual funds according to Morningstar – which means people were putting money into the market), historically, investors put more money into a rising market (buying companies at a premium) and take money out of falling market (sell companies at a discount).