Many people get very confused by the two. They’re often assumed to be synonymous with one another. The truth is they are very different, sometimes even contradictory. Rich, is what is perceived by people on the outside. It’s best portrayed by how you spend your money. Wealth, on the other hand, is not what you show, but more accurately, what you have. My general observation has been that in order to appear rich, you must spend money. This exercise, by its very nature, generally reduces your wealth.

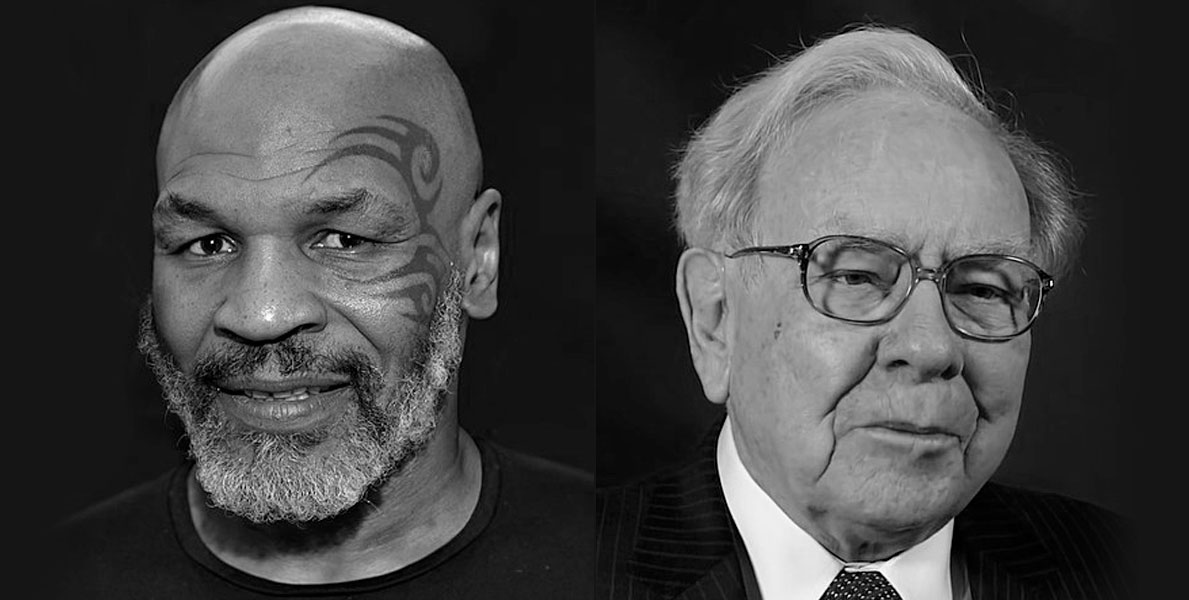

I recently finished reading the Psychology of Money, by Morgan Housel. He addressed the concept of rich vs. wealthy, which resonated with me. It brought me back to an article I had read many years ago that illustrated Mike Tyson’s “wealth” in his glory days. Mike Tyson was earning so much money, that he spent a small fortune ($2.2M) on a gold bathtub. From the outside looking in, this is a very rich man. Fast forward to 2003, Mike Tyson declared personal bankruptcy. Incredibly rich, however, no wealth.

Enter Warren Buffett. The absolute polar opposite. He still lives in the same house that he bought in 1958 in Omaha. Its worth is approximately $650,000. From the outside looking in, he would not be regarded as a rich man. However, his overall net worth of over $88B would suggest he is wealthy beyond our comprehension.

Can we only assume that Warren Buffett achieves superior returns on his investments? No doubt, Buffet has done well with his investments, but I assure you this is not the sole difference. It can all be broken down to basic spending and savings habits. This will be the biggest factor in determining your financial future. It may come as a surprise to many of you, but not to us. In our years acting as financial advisors, we have been privy to and experienced both scenarios. There will always be good and bad returns. Ultimately, it’s spending and savings habits that will determine whether you are rich or wealthy.